Simplify Administration

Outsource tedious tasks and processes to free up critical resources for strategic, high-value work.

A trusted partner can manage the key drivers of administrative complexity and free up critical resources needed to support major strategic initiatives and focus on delivering a benefits program that connects health and wealth – and results in a better benefits experience for everyone.

How: Benefitfocus brings together technology and a culture of service excellence to simplify administration, drive efficiencies and enable organizations to focus on what’s most important.

- Employee Communications

- Reporting

- ACA Compliance

- COBRA Administration

- Billing

- Consumer Accounts

- Voluntary Benefits

Enable Smarter Decisions

Reduce friction to help employees get more value from their benefits across health and wealth.

Help your workforce understand their benefit offerings and make confident decisions through personalized decision support tools and targeted benefit communications campaigns that connect the dots between their needs and company-sponsored benefits.

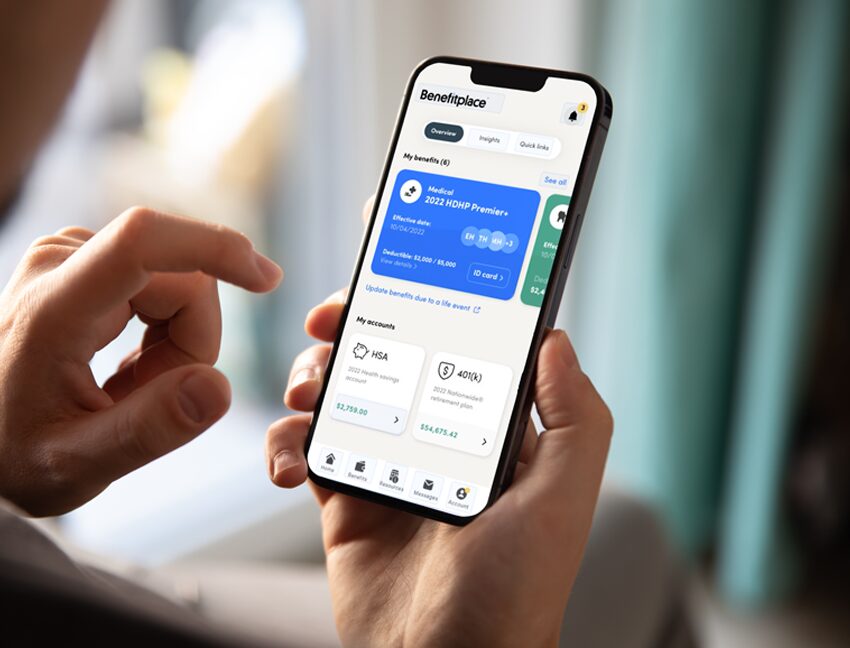

How: HRZ Benefits, powered by BenefitFocus makes it easy for employees to make smarter decisions about their benefits through a connected experience across health, retirement and household savings.

- Personalizedd, centralized benefits hub

- Top-rated mobile app for convenient on-the-go access

- Simple enrollment experience with data-driven decision support

- Targeted communications to nudge employees to their next-best action

- Integrated care navigation – included as a standard feature

- Service center for call, email and 24/7 chat support

Boost Engagement

Harness the power of data to help you evaluate program effectiveness and take action for improved outcomes and lower costs.

Benefits data reveals what’s working and what’s not, while exposing areas for improvement. For example, data can help you identify opportunities to deliver more effective benefits communications or to engage employees in specific programs that support their goals.

How: Benefitfocus enables better health and financial outcomes through on-demand access to your health plan claims data and powerful insights. Analytics tools and services help you:

- Understand what’s driving your healthcare costs

- Identify risks and opportunities for improvement

- Adjust your benefit strategy

- Measure results

- Additional services that attack specific areas of your health plan – such as claims errors leading to overpayments – and take proactive, cost-savings measures on your behalf.

Create a holistic benefits experience that supports employees’ health and financial well-being while reducing organizational costs and administrative burdens.

How to Shift to a More Effective Benefits Administration Strategy – eBook

Benefit leaders share with us how imperative it is to support employees’ health and financial wellbeing. While employers are doing the right things – introducing competitive benefits, providing digital resources and communicating throughout the plan year – employees just don’t know how to take full advantage of their benefits as part of a connected experience. Considering that close to 30 percent of compensation costs go towards benefits, it’s clear why employers are ready and eager for a better way.

In this eBook, you’ll learn:

- Why the traditional approach to benefits administration is failing

- The power of getting your workforce benefits and savings in sync

- Three actions you can take to transform the benefits experience for everyone

Unlocking the Power of Health Care Claims Data to Enhance Benefits

Navigating the landscape of health care claims data analytics is a necessary initiative for today’s benefits leaders. Employers cannot afford to not incorporate valuable insights from the benefit offerings their employees rely on. In the best-case scenario, an effective health care claims data analytics solution can help benefit leaders manage costs, improve benefit programs, boost utilization and provide a better benefits experience for employees, all of which can contribute to a happier, healthier workforce.

DOWNLOAD